More comprehensive article were published yesterday by AM Costa Rica. Unfortunately the chart and formulas will not copy so if you are effected by this tax you might want to go to AM's website and read the articles.

Quote:

Expats likely to be blindsided by new 'luxury home' tax

By the A.M. Costa Rica staff

Most expats who own what the government categorizes as a luxury home probably are unaware that they are subject to a special tax Jan. 1

The tax has been the subject of many newspaper articles, including several when the measure passed the legislature a year ago. The law went into effect Oct. 1, and owners of homes worth more than 100 million colons, about $172,000 have until the end of the year to register their property and to provide an estimated value.

The possibilities for fines and assessments are numerous. For example, if the Dirección General de Tributación experts think a homeowner has undervalued a property by more than 10 percent, there is a hefty fine of five times the taxes that should have been paid.

A systemic problem is that Tributación seems committed to a cost approach to valuation rather than one that determines real value from the comparison of sales prices. Accurate figures for property sales are not now available in Costa Rica because many purchasers lie and state a low figure for the transaction despite what they actually paid. Notaries go along with this charade.

The law, No. 8683, is designed to provide funds to give housing to the extreme poor. The law also would appear to be a boon for appraisers and others who would help homeowners complete the complex forms.

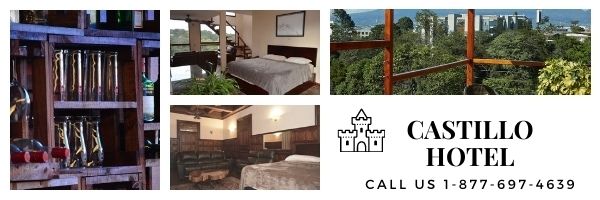

Some expats think that the measure will damage the already frail real estate market. The law is likely to hit hotels hard because they are included as places of habitation.

A homeowner with a house worth just 100 million colons could expect to pay a tax of just one-fourth of a percent. That is 250,000 colons or about $430.

A property owner with a home and grounds worth 500 million (about $860,000) would pay three-tenths of a percent on any value over 250 million. That's 750,000 colons or $1,288. The total tax would be $2,363.

Certain structures used for housing are exempt from the law, including public and church properties, structures owned or occupied by non-profits engaged in social work, housing at the Instituto Centroamericano de Administración de Empresas, Universidad EARTH, Centro Agronómico Tropical de Investigación y Enseñanza and the Universidad para la Paz, and structures declared historic by the Ministerio de Cultura, Juventud y Deportes.

To avoid a threshold amount creeping lower, the government is empowered to apply an adjustment based on the annual cost of living.

Not apparent in the proposed law was that hotels will be covered. Discussion at the time said that commercial enterprises would be exempt, but a worksheet put out by Tributación specifically includes hotels. That could be a significant financial blow to struggling hotel owners.

The declaration that an owner makes by Jan. 1 is good for three years unless Tributación finds fault. A new declaration has to be made during the first 15 days of the fourth year. 2009 is a special case in that owners have

tax rate chart

three months to present their estimates of value. Then

they have to pay three-months of the taxes to cover the period from October to Jan. 1. Then they also have to pay the 2010 tax by Jan. 15.

One curve thrown by legislators is that the money paid for this tax is not deductible on income tax statements, according to the law.

Condo owners have a special reporting problem. They have to include their portion of the value of the property held in common, like swimming pools, access roads, ranchos or meeting rooms. Each condo board will have to establish a value and pass that information on to the individual owners.

Owners who hold property in common with others seem to have to report the value along with the other owners.

Another group with special problems are snowbirds who might not be paying attention to political and tax developments in Costa Rica. They own property here but only visit one or two times a year.

A description of the new law is HERE.

An example of forms to report ownership and also value are HERE. Real forms are supposed to be available this week.

The law also said that municipalities have to report the issuance of building permits. The Colegio Federado de Ingenieros y Arquitectos, which approves building plans, also has reporting obligations, said the law.

The income from the tax is earmarked for the Banco Hipotecario de la Vivienda, which would use the funds to build housing for the poor now living in slums, according to law. According to figures from the Ministerio de Vivienda y Asentamientos Humanos there are 182 such slums in the metropolitan area with 116 in San José, 41 in Cartago and 16 in Alajuela. Some 208 slums are outside the Central Valley, according to the ministry.

The ministry reported that by 2004 some 32,797 families were living in slums or makeshift subdivisions, but the number certainly is much higher.

The tax on luxury homes is supposed to last just 10 years, but lawmakers have been known to extend taxes.

Quote:

Tributación tries to reduce land value to a math formula

By the A.M. Costa Rica staff

Someone stayed up nights exerting gigantic effort to make the new luxury tax law as complex as possible.

Tax experts have established standards for everything from rolling landscape to the default price of rural land.

The specifics are in a decree issued by the Dirección General de Tributación Sept. 24.

Although the technical specifications seem reasonable in the beginning, they quickly become complex. The rules specify a cost approach to valuation and ask homeowners to use a manuel that has construction costs listed. Then it asked the homeowner to estimate the useful life of the structure so a depreciation index can be applied. So far that is fairly standard.

But when it comes to land, Tributación moves away from the cost approach and says that homeowners should use a code that identifies where the property is located. Then there are corrections for street frontage and type of street, grade, area, and other aspects. There even is a correction for the degree of grade. All land is not the same, and no more is being made, so a cost approach is invalid. But

Tributación seeks to compartmentalize properties even though properties that appear similar can have major differences for various reason.

More subtle corrections are made with a number of strange formulas that appear to be made up by Tributación:

And then there is a really interesting formula for forest land:

Although this may seem very obscure, Tributación is sure to have technicians very conversant in these techniques who will be evaluating the valuations of homeowners.

The decree is on the Web site.

_________________

Pura Vida

Only Irish coffee provides in a single glass all four

essential food groups:

alcohol, caffeine, sugar and fat.

Alex Levine